Celebrating a Season of Impact: October & November in Review!

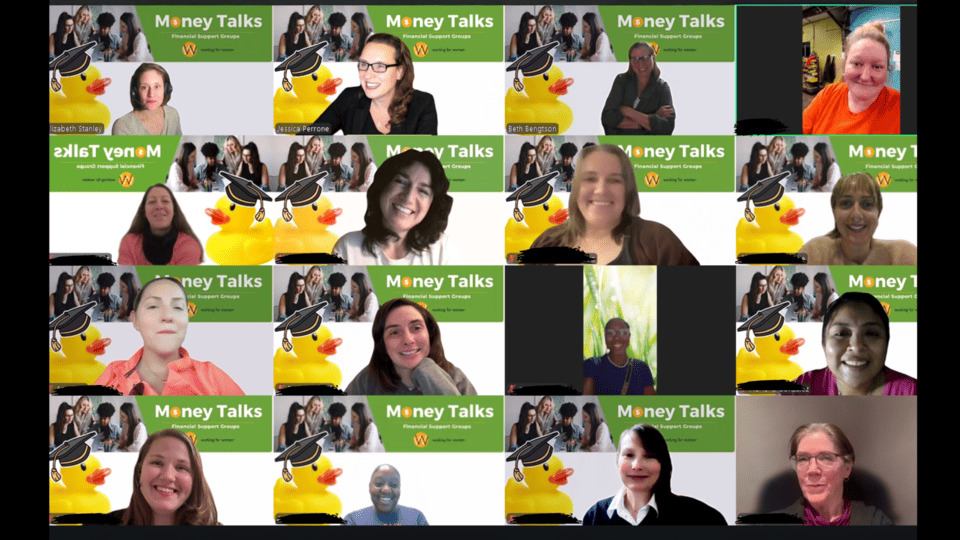

What an incredible whirlwind of connection, learning, and financial empowerment these past two months have been! From dynamic workshops to insightful panels and the inspiring graduation for the Working for Women (W4W) Money Talks program I helped create, October and November were packed with opportunities to share vital financial knowledge and help individuals take confident strides toward their financial futures.

Every time I step on stage or join a discussion, I’m reminded that understanding money isn’t just about numbers; it’s about mindset, confidence, and taking intentional steps toward the life you want. This fall, I’ve had the honor of working with diverse groups,from professional women and veterans to entire banking communities, helping them uncover their financial goals and leave with actionable plans.

Building Confidence: From Financial Foundations to Investing Milestones

The fall season was dedicated to equipping individuals with both foundational stability and wealth-building confidence.

Throughout October, my focus was on crucial financial fundamentals and community programs:

- Oct 1 & Oct 7: Investing Deep Dives I partnered with Working for Women for a program session on “Planning to Invest: Your Investing Journey” (Oct 1) and with Pittsburgh Professional Women (PPW) for “Investing $ense” (Oct 7). The goal was always the same: to strip away the intimidation factor and empower women to take control of their wealth-building.

- Oct 23: Tackling Resilience. At Neighborhood Allies, we dove deep into “Debt Strategies,” where attendees walked away with clear, actionable plans for tackling debt and building a stronger financial foundation.

- Oct 28 & 29: Program Session & Risk. I continued my partnership with Tioga Franklin Savings Bank leading the “Money Talks: Intro-Ducktion to the Financial Ducks” session (Oct 28), focusing on the Mindset Reset. I also presented on “What’s Risk Got to Do With Investing” with the YMCA Financial Wellness Series (Oct 29).

Celebrating Progress and Expanding Expertise

November brought milestones, deeper learning, and key industry engagement:

- Nov 4: Stocks Simplified. Back with Pittsburgh Professional Women (PPW), we held a session on “Stocks Simplified” to solidify confidence in investment decisions.

- Nov 5: Graduation Milestone. The season culminated in the joyful Working for Women Money Talks Program Graduation. Celebrating the successful completion of the program I helped create was a true highlight and a testament to sustained partnership.

- Nov 16: Community Support. I was honored to sponsor the Breakfast of Champions 2025 for Breakthrough of Greater Philadelphia, supporting community-driven change.

Going Beyond the Schedule: Dedicated Outreach and Industry Voice

My fall schedule also included several high-impact volunteer efforts and industry-level discussions that broadened our reach:

- Veterans & Community: I continued my deeply rewarding volunteer work with Valley Brook Veteran Village / YMCA on “Mission Ready: A Veteran Guide to Financial Ducks.” I also shared financial insights with The Somerset Hills Collective and participated in an expert panel for Believe Inspire Grow (BIG).

- Industry Voice: I was honored to connect with global audiences at the NASDAQ Economic Opportunity Summit & Purpose Week and attended the New Jersey Citizen Action Financial Justice Summit, admic financial change.

The Ultimate Success Story: Real, Measurable Results

The true measure of impact isn’t the number of speaking engagements—it’s the measurable change in the lives of the participants. The survey feedback from my custom programs provides undeniable proof of success:

From Fear to Action: The Confidence Shift

We are shifting mindsets and driving commitment to long-term financial health:

- 100% of participants reported they are now more likely to save for a long-term goal.

- 100% of participants feel more confident in their ability to learn how to invest.

- 100% of participants feel better equipped to use credit as a tool.

Voices of Empowerment

The quotes capture the transformation better than any statistic:

- “A million times better [knowledge-wise]… Now I have the tools to grow wealth, and it is no longer an unsolvable mystery.”

- “I went from just survival mode to feeling I could confidently take steps forward to be financially successful even as a single mom of three.”

- “I now feel much more confident, empowered, and informed about my personal finances. I have a clearer understanding of how to budget, manage debt strategically, and make intentional choices…”

Ready to Create Your Own Success Story?

This season has reaffirmed my mission: to create real impact by shifting mindsets, building confidence, and inspiring action.

Thank you to all my partners, from Tioga Franklin Savings Bank to the YMCA, for your trust and commitment to financial empowerment.

If your organization is looking for a speaker or workshop leader who delivers proven, measurable results for your teams, members, or community, let’s connect and build a plan for your success in the new year.